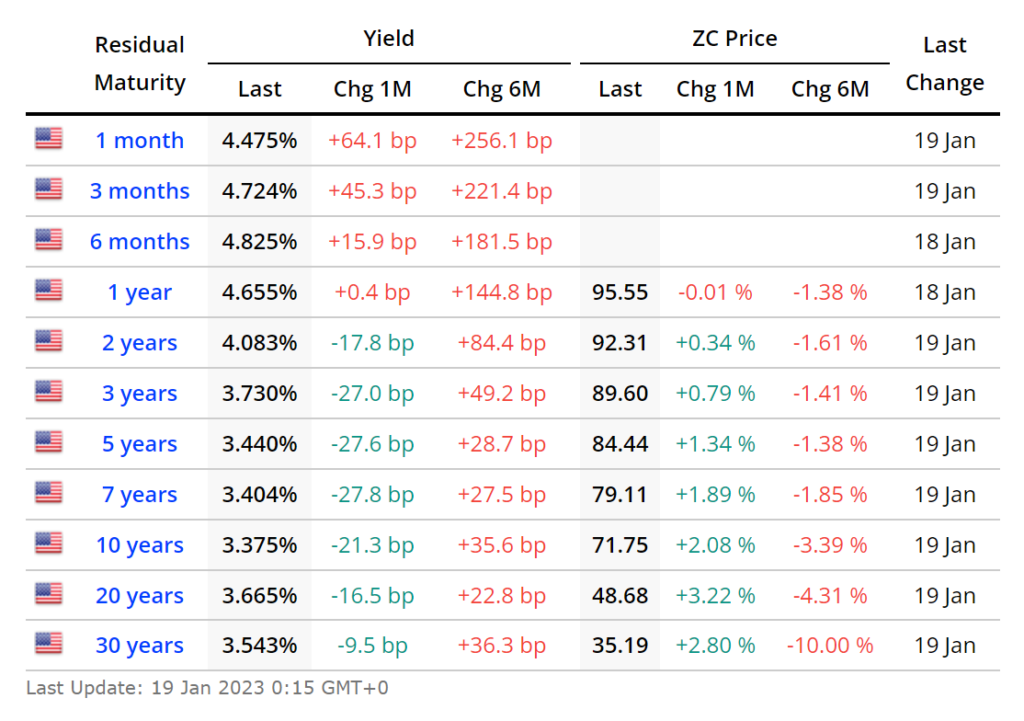

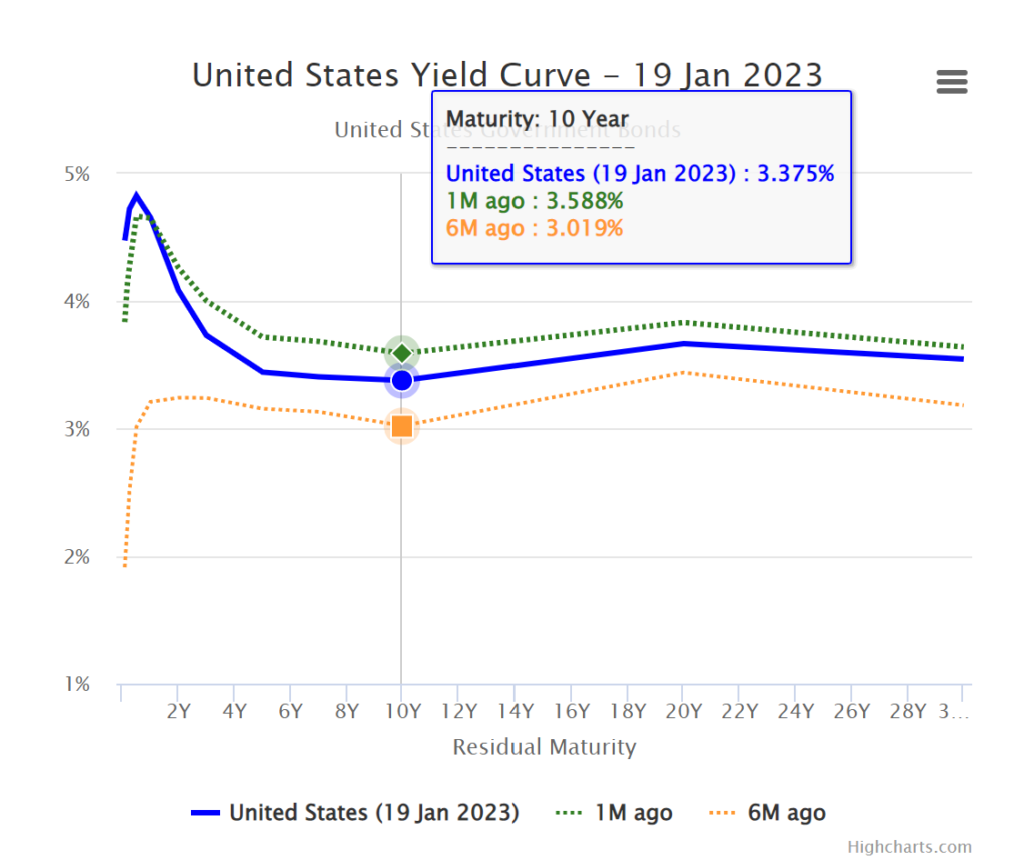

The United States 10-year government bond currently has a yield of 3.375%, while the 1-year government bond has a yield of 4.655% and the 1-month Treasury has a yield of 4.475%. This inverted yield curve, where long-term yields are lower than short-term yields, is a significant development in the financial markets, as it has historically been a strong indicator of an impending recession.

An inverted yield curve occurs when the interest rate on short-term Treasury bonds is higher than the interest rate on long-term Treasury bonds. This is unusual because, in normal circumstances, long-term bonds have higher yields than short-term bonds to compensate investors for the added risk of tying their money up for a longer period of time. When the yield curve inverts, it suggests that investors are more worried about the short-term economic outlook than the long-term.

Yield Spread

The 10-year vs 2-year bond spread, which is the difference between the yield on a 10-year Treasury bond and a 2-year Treasury bond, is -70.8 basis points. A negative spread is a clear indication of an inverted yield curve.

Historically, an inverted yield curve has preceded every recession in the United States over the past 50 years. An inverted yield curve is often seen as a leading indicator of a recession because it suggests that investors expect economic growth to slow in the future. As a result, they demand a higher return for lending money for a shorter period of time than for a longer period of time.

The central bank rate, which is the rate at which banks can borrow from the central bank, is currently at 4.50% (last modification in December 2022). A high central bank rate can also invert the yield curve. A high central bank rate can make short-term interest rates more attractive to investors, causing them to demand a higher return for lending money for a longer period of time.

In conclusion, the inverted yield curve in the United States, where long-term bond yields are lower than short-term bond yields, is a significant development in the financial markets. Historically, an inverted yield curve has preceded every recession in the United States over the past 50 years and it is often seen as a leading indicator of a recession. The central bank rate also plays a role in the inverted yield curve, a high central bank rate can make short-term interest rates more attractive to investors. Investors should be cautious and consider their investment strategy accordingly.

Be First to Comment