Over the past several months the lending standard for banks has tightened significantly. This has broad reaching implications on the availability of money and credit for businesses in need as as well as the risk of default on high yield loans, such as those issued by companies with weaker credit ratings.

The tightening of bank lending standards is a result of a number of factors, including increased regulatory scrutiny and a more cautious approach to lending in the wake of the financial crisis. Banks are now required to hold more capital, which makes it more expensive for them to make loans, and they are also subject to stricter rules around underwriting and risk management.

This has had a significant impact on the availability of credit for companies with weaker credit ratings, as well as on the prices of high yield bonds and loans. As a result, many companies have been forced to pay higher interest rates on their debt, and some have been unable to borrow at all.

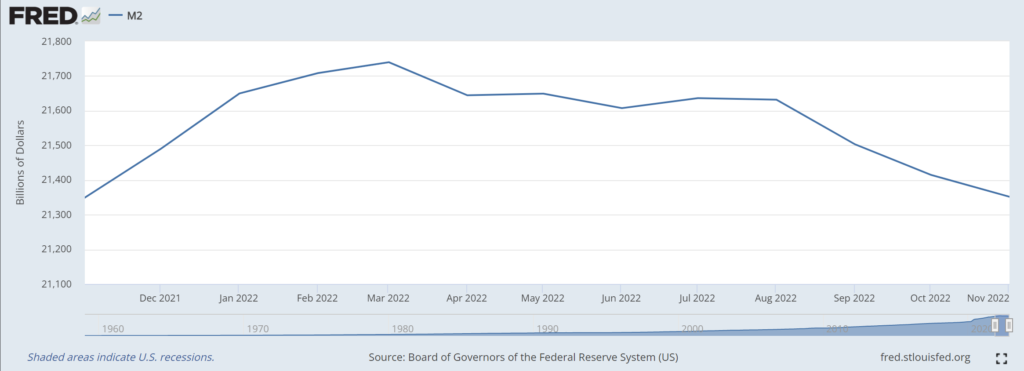

The next several months are likely to be quite rough for risk assets, such as crypto, high yield credit, and stocks. With the high yield default rate expected to rise, investors are likely to become more cautious and pull back from riskier assets. This could lead to a sharp decline in asset prices, particularly for those assets that are most closely tied to the credit markets.

In contrast, US Treasury bonds, known as USTs, are likely to be seen as a safe haven during this period of uncertainty. As investors flee from riskier assets, they are likely to seek out the relative safety of US government bonds, which are considered to be among the safest investments in the world.

Reserve Requirement vs. Capital Requirements

It is also worth noting banks are not required to hold a certain percentage of their assets as reserves, this is not the same as capital. Reserve requirements refer to the amount of cash or highly liquid assets that banks are required to hold on hand to meet withdrawal demands from depositors and to meet unexpected cash needs. Reserve requirements are set by central banks and are used as a monetary policy tool to control the money supply and stabilize the economy. Banks are required to hold a certain amount of capital, which is a measure of a bank’s financial strength and its ability to absorb losses. Capital requirements are set by regulatory bodies, such as the Federal Reserve, the Office of the Comptroller of the Currency (OCC) and Federal Deposit Insurance Corporation (FDIC), and are used to ensure that banks have enough financial cushion to continue operating even during times of stress. Banks must maintain a minimum amount of capital to be considered well-capitalized and to be able to operate.

In conclusion, bank lending standards have tightened significantly, and they are now at a level that is consistent with high yield default rates of around 8% nine months later. This is likely to have a negative impact on risk assets such as crypto, high yield credit, and stocks in the coming months, while USTs are likely to be seen as a safe haven. Therefore, investors should be cautious and consider their investment strategy accordingly.

Be First to Comment