The Fisher effect is an economic theory that states that the nominal interest rate is equal to the real interest rate plus the expected inflation rate. This theory is named after economist Irving Fisher who first postulated it in 1930.

The Fisher effect can be represented by the following formula:

i = r + πe

Also stated: r = i – πe

Where: i = nominal interest rate r = real interest rate πe = expected inflation rate

The real interest rate represents the return on an investment after adjusting for inflation. It is the nominal interest rate minus the expected inflation rate. The expected inflation rate is the rate of inflation that investors expect to occur in the future.

The Fisher effect is important because it helps to explain the relationship between interest rates and inflation. According to the Fisher effect, if investors expect inflation to increase, they will demand higher nominal interest rates to compensate for the loss of purchasing power. Conversely, if investors expect inflation to decrease, they will accept lower nominal interest rates. The Fisher effect is based on the assumption that investors are rational and forward-looking. It also assumes that the money supply is constant and that there is no change in the rate of productivity.

The Fisher effect is used by central banks and governments to understand how monetary policy affects interest rates and inflation. It is also used by investors to make decisions about the best investments to make in different economic conditions. The Fisher effect is used by central banks and governments to understand how monetary policy affects interest rates and inflation, and by investors to make decisions about the best investments to make in different economic conditions.

The FED under the current regime announces whether the fed funds target has been increased or decreased or left unchanged after the monthly FOMC meeting ~previously changes had been kept secret. To find short term interest rate targets the FED follows “loosely” the Taylor Rule:

1) Where is inflation relative to the target level

2) what extent is the economy above or below full employment

3) what should short term rates be to achieve full employment

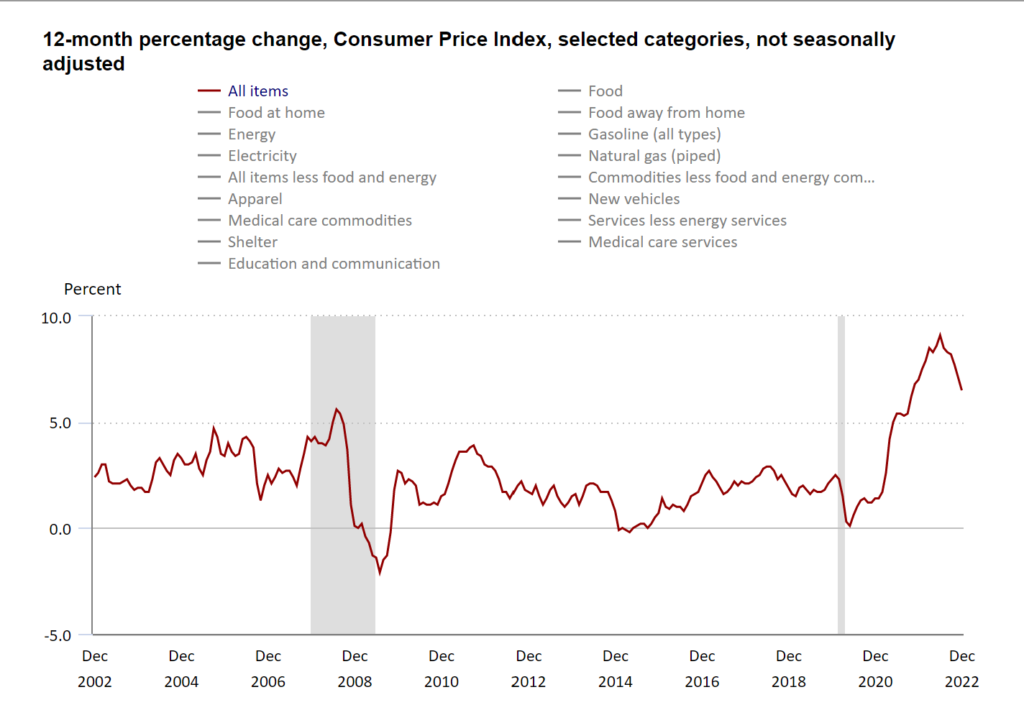

The latest report on the Consumer Price Index (CPI) shows a decline of 0.1 percent in December 2022, on a seasonally adjusted basis, following a 0.1 percent increase in November 2022. Over the last 12 months ending in December 2022, the all-items index increased 6.5 percent before seasonal adjustment. This indicates a slowdown in inflation, which is a key indicator of the health of the economy.

This is very different from the situation in December 2021, where the CPI increased by 0.5 percent on a seasonally adjusted basis after rising 0.8 percent in November 2021. Over the last 12 months ending in December 2021, the all-items index increased 7.0 percent before seasonal adjustment, which shows a high inflation rate.

FED Rate Hikes

The Federal Reserve has been raising interest rates since March 17th, 2022, with the latest hike on December 14th, 2022, bringing the policy rate up to 4.50%. The Fed has raised rates by 425 basis points in 2022, a significant increase.

However, the economy is showing signs of weakness. GDP decreased at an annual rate of 1.6% in the first quarter of 2022, and shrank by 0.9% in the second quarter. This confirms that the economy is in a recession.

The inverted yield curve, where long-term bond yields are lower than short-term bond yields, also signals that a recession is likely. Historically, an inverted yield curve has been a reliable indicator of an impending recession.

In light of these economic indicators, it is questionable whether the Fed’s decision to continue raising interest rates is appropriate. Higher interest rates tend to slow down economic activity, and in the face of a dying economy, it may not be the best course of action. Some experts believe that the Fed should consider cutting rates or taking other measures to support economic growth.

In conclusion, the latest report on the Consumer Price Index shows a slowdown in inflation, but the economy is in a recession, and an inverted yield curve indicates that a recession is likely. The Fed’s decision to continue raising interest rates in the face of a dying economy raises concerns and experts suggest that the Fed should consider cutting rates or taking other measures to support economic growth.

Be First to Comment