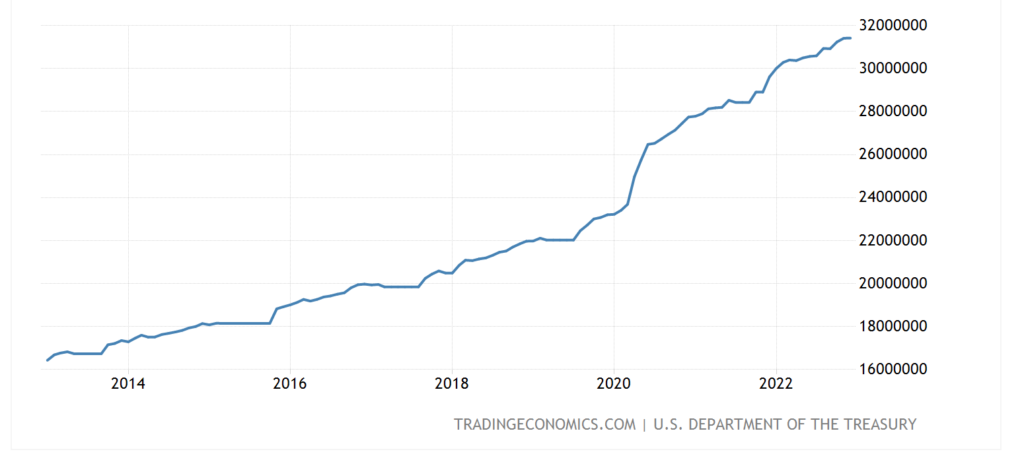

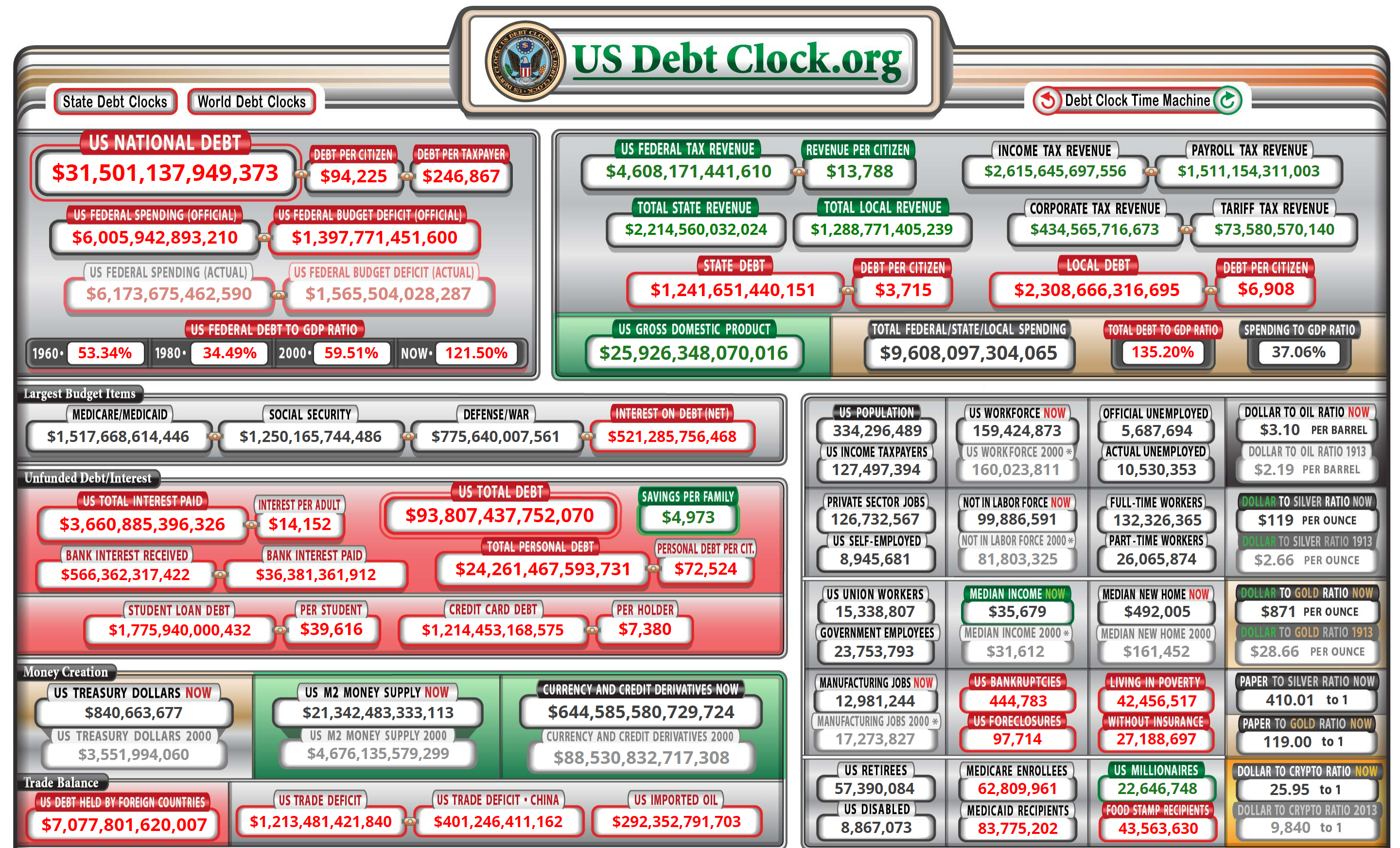

The United States debt has been on a steady upward trajectory for the past several decades. On October 22, 1981, US debt hit $1 trillion dollars under President Reagan. Since then, US debt has gone from $1 trillion to almost $32 trillion. This is a staggering increase in debt, and many experts are concerned about its sustainability. The main driver of the increasing debt is increasing government spending financed through debt monetization by the Federal Reserve (Fed) and the US Treasury. Government spending has been on an upward trend for decades, driven by rising costs for programs such as Social Security and Medicare, as well as military spending and other discretionary programs.

In addition, the Fed has been engaging in debt monetization, which is the process of creating new money to purchase government debt. This can lead to inflation and can weaken the value of the currency.

The accumulation of debt on this scale is unsustainable and could lead to serious economic consequences. Some experts warn that the only result of this trend is default or an inflationary depression. Default occurs when a government is unable to pay its debt and may result in a financial crisis. An inflationary depression is a severe recession accompanied by a high rate of inflation.

The situation was further exacerbated by the government response to the COVID-19 pandemic, which has led to a significant increase in government spending and a decline in economic activity.

Given the current economic and political climate, it is unlikely that the US debt will be brought under control in the near future. However, it is important for policymakers to address this issue and develop a plan to reduce the debt over the long-term. This could involve a combination of measures such as reducing government spending, increasing taxes, and implementing structural reforms to entitlement programs.

The endgame for an unsustainable level of debt is uncertain and can depend on a variety of factors, including the actions taken by policymakers, the state of the economy, and the global financial system.

One potential outcome is that the government may default on its debt, which would result in a financial crisis and potentially lead to a severe recession or depression. This could lead to a loss of confidence in the government’s ability to repay its debt, and a decrease in the value of the currency. Its worth noting that the US has defaulted “several times” in the past to varying degrees. In 1971, Nixon defaulted off the gold the standard internationally. This meant that the US would not exchange USD for Gold at the previously agreed upon rate.

“President Nixon announced this act as temporary: ‘I have directed [Treasury] Secretary Connally to suspend temporarily the convertibility of the dollar into gold.’ The suspension of course became permanent, allowing the unlimited printing of dollars by the Federal Reserve today”.

Another potential outcome is that the government could try to inflate away the debt by increasing the money supply and causing inflation. This could lead to a decrease in the value of the currency, and could cause prices to increase rapidly, which would make it difficult for people to afford basic goods and services but would allow for large amounts of debt to be paid off in nominal terms relatively easily.

A more sustainable solution would be for the government to implement policies to reduce its debt over time through a combination of measures such as reducing government spending, increasing taxes, and implementing structural reforms to entitlement programs. This could help to stabilize the economy and restore confidence in the government’s ability to manage its finances.

It’s worth noting that the endgame scenarios also depends on how other countries react to the US debt situation, how the US dollar performs as a global reserve currency, and how the US debt is perceived by investors, all of these factors can play a role in the outcome.

In summary, the endgame for an unsustainable level of debt is uncertain and can depend on a variety of factors. Possible outcomes include default, inflation, or a combination of policies to reduce the debt over time. Ultimately, the situation will depend on a variety of factors, including the actions taken by policymakers, the state of the economy, and the global financial system.

Be First to Comment