When one begins to examine the economic condition of the United States the first thing you would question is the deficit spending. After all, if the US were a corporation and the expenses outweighed the receipts annually, to the tune of trillions of dollars being added to the debt column annually, then the unsustainability of the situation would be seen by all. But for many reasons, some understood and others not so clear, the fiscal situation of the US is not only overlooked but propagandized. It would be as if you were at a table playing cards and everyone in the room knew you were bluffing but no one called you on it. The US Congress every so often meets to discuss the raising of the debt ceiling. The debt ceiling or debt limit is a legislative limit on the amount of national debt that can be incurred by the U.S. Treasury, thus limiting how much money the federal government may borrow. Having a debt ceiling by itself does nothing to limit spending or borrowing. This is to say that if you have a budget on spending and every time you approach or exceed said budget you raise the limit do you truly have a budget? Are there truly any restraints on spending? If Congress meets one year and establishes a debt ceiling of $22 trillion but not even two years later is forced to raise the ceiling to a number even higher, was there even a limit imposed in the first place or was it a time constraint? The debt ceiling has been raised 90 times in the 20th century; 18 times under Ronald Regan, 8 times under Bill Clinton, 7 times under George W. Bush, and 5 times under Barack Obama. Since 1960, Congress has acted 78 separate times to permanently raise, temporarily extend, or revise the definition of the debt limit. This over the many years has put us in a situation where we are roughly $31.5 trillion in debt. This is fiscally unsustainable. Before a solution is sought one MUST ask the question who is to blame for this? This has several answers, some broader than others but the two parties directly responsible are the US Federal Reserve (Fed) and the US Treasury.

The Federal Reserve, Debt Monetization

The Federal Reserve was established to be a private institution, it is a private banking syndicate. This is to say it was made to be a separate body from the government. The reason constitutionally the Fed had to be a private institution is because congress was not given the power to issue bills of credit. The original mandate of the Fed was to maintain an elastic money supply; to allow for the supply of money to expand as the economy expanded and to contract as the economy contracted. This would ideally allow the economy to be more adaptable to the current economic environment. But the Federal reserve has become an arm of the US government. It facilitates deficit spending and enables the maintenance of an unsustainable fiscal policy. The Fed is responsible for the creation of currency. It does not mint currency for this is the job of the Treasury, or the US government; but most of the money in an economy comes from private banks making loans to individuals, businesses, or other banks. Every time that a new loan is issued it creates a loan which is held as an asset to the bank and liability to the customer, and a deposit which is a liability to the bank and an asset to the customer. Currency is electronically created in this way by banks. The Fed through open market operations creates bank reserves and purchases short term treasures from banks in need of funds. Through this the Bank receives new liquidity and the Fed receives short term treasuries. In open market operations the Fed is not creating currency they are creating bank reserves and exchanging them for short term securities.

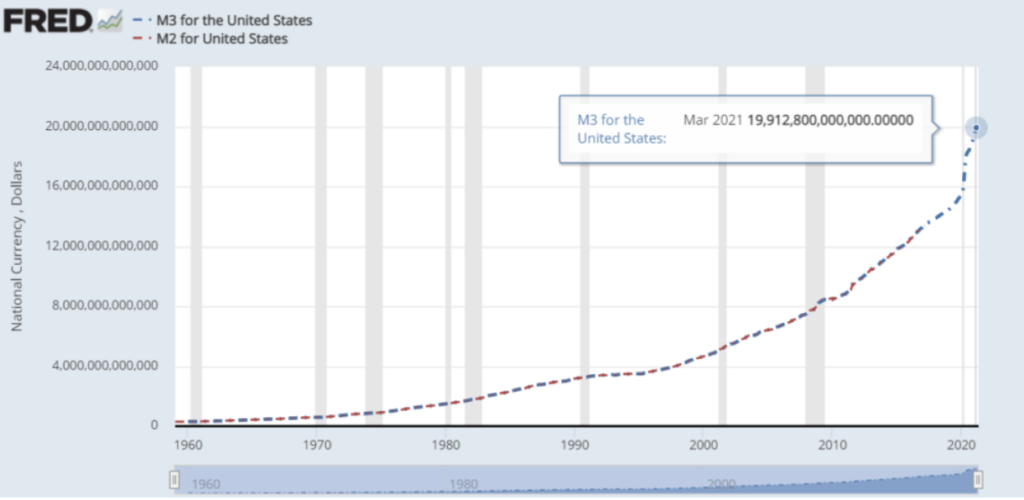

Quantitative easing (QE) on the other hand is very similar but very different. Quantitative easing is a large-scale asset purchasing program where the Fed purchases longer maturity government bonds, and other private sector assets. QE is an asset swap where the central bank creates bank reserves, the money used in the overnight lending market, and uses them to purchase assets from private banks. The reserves themselves are created out of thin air. This increases the amount of money that banks and financial institutions have on hand, and banks can use these funds to provide loans. The Fed creates “new money” when it buys things, and the main thing the Fed buys is U.S. sovereign debt, i.e. U.S. securities, a.k.a. treasuries. Through the purchase of treasuries at auction the Fed creates money for congress.

It’s through this practice that the Fed enables the deficit spending of congress. What becomes more concerning is the relationship between the Chairman of the Fed and the Treasury secretary. The Fed chairman, Jerome Powell. and Treasury secretary, Janet Yellen, can be seen holding joint press conferences as if they are both government bodies with an aligned goal. As we have discussed earlier the Fed is a private entity. Its job is not to fund government spending. In 1977 Congress changed the mandate of the Fed. Since ’77 the mandate of the Fed has been to, “promote effectively the goals of maximum employment, stable prices, and moderate long term interest rates”. In theory none of these goals have any direct dealing with the government but in practice the Fed has become an arm of the government.

Government Data

Many of the thinkers from the new economic school of thought, Modern monetary theory (MMT), proclaim that these forms of currency creation, OMO and QE, have no impact on inflation. In this sense they define inflation as a general rise or increase in prices. They would be correct to assert that in the years after the several QE programs we did not have a surge in prices as measured by government statistics (such as the CPI) but we did see an enormous surge in asset prices. If you look at a stock market index such as the Dow and look from the start of QE to now you will see a rise to such a significant degree that it can not be denied that asset prices after QE have been inflated.

This is not only true for the stock market but for real estate as well and so on and so forth. What is also notable is that while we may have not seen a surge in prices we did fail to see prices fall for consumer goods. All things being considered in today’s economic environment these same claims about inflation or the lack of can not be made. We have had more inflation as measured by government statistics in 2021 alone than we have had for decades. The core CPI is the highest its been since 1992. These levels of inflation can be principally blamed on the government stimulus that was sent to Americans during the Covid-19 pandemic. When money is sent to Americans in the form of stimulus checks it puts dollars directly in the hands of Americans who upon spending it increase velocity. The latest CPI numbers that were reported for June came in at .9% increase beating high end expectations. It would not surprise me if by the end of the year we were seeing double digit inflation as measured by the CPI. What should concern Americans even more is that in an environment where the Fed is forced to combat double digit inflation any of the tools that they have to combat it would force the US economy through a harsh correction. And if faced with the choice to raise interest rates or to allow inflation to wreak havoc the Fed would be forced to raise interest rates to such a level that the economic landscape would be completely changed.

Perhaps the most important reason to be skeptical of government inflation numbers is that the government, like a fox campaigning to guard a hen house, has many reasons to be disingenuous. As the world’s largest debtor, the Federal Government is inflation’s primary beneficiary.

Peter Schiff

Be First to Comment